Expiations for De-Globalization

De-globalization is argued to be occurring in large part due to populist forces, from both the political left and right, that have produced anti-globalization movements around the world (Rodrik, 2018). The turn towards populism, particularly when combined with anti-globalist, economic nationalist policies,[1] partly reflects the intense and multifaceted effects that globalization has had on many people around the world (Giddens, 2000). Voters in many countries, rightly or wrongly, believe that foreign competition, relocation of domestic manufacturing plants to lower cost locations overseas, and immigration are responsible for low and unequal wages[2] and, within this context, see globalization as a source of uncertainty and unpredictability that threatens their own livelihoods. Faced with uncertainty, many individuals have come to identify with populist social movements led by ideological and powerful leaders that use economic nationalist rhetoric to assure their supporters (Hogg, 2007). These populist leaders decry those things their supporters fear, including economic globalization, and they have, at times, sought to undermine the global institutions that promote global integration. However, evidence does not suggest that populist leaders espousing economic nationalist policies have significantly curtailed international trade or investment in practice, as shown below.

Economic Globalization in the 21st Century

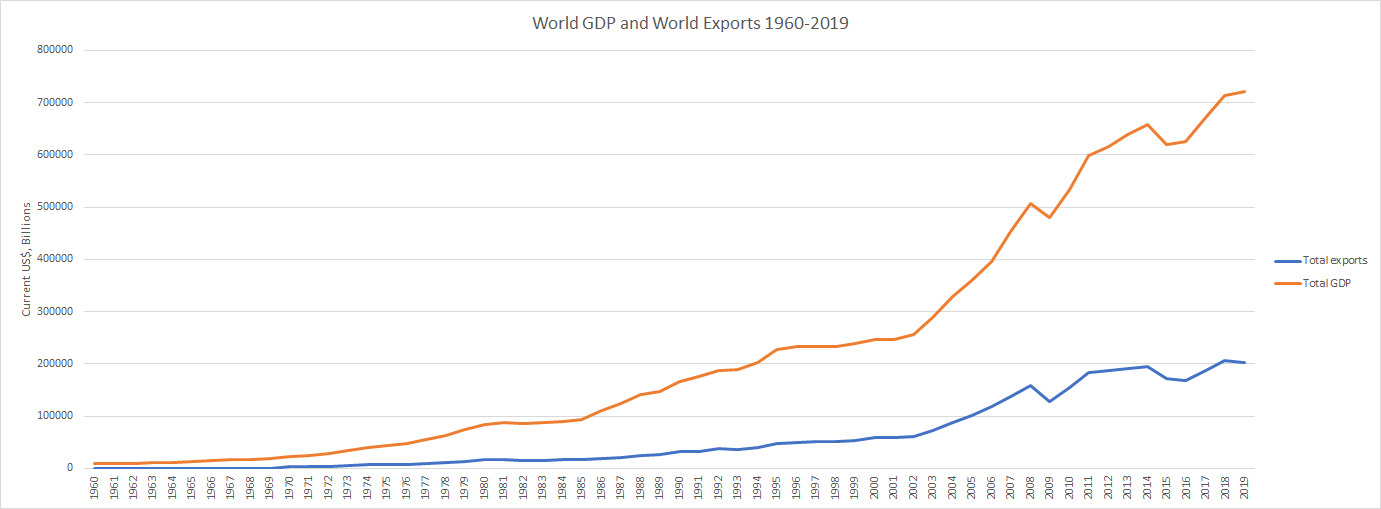

Contrary to the increasingly common claim that globalization is in decline, data suggest that global integration remains at or near its peak, even despite the rise of populist, nationalist political leaders. This is evident when we look across a host of common indicators, including international trade and foreign investment. Consider Figure 1, which shows the trends in world trade since 1960.

As the figure shows, world trade and world income have each grown fairly consistently through the decades. The 2010s showed a slowdown in that growth from previous decades, but trade remains near its peak, and it remains above 40% of global GDP. It is worth noting that trade has fallen as a share of GDP, but (as Figure 1 shows) this is driven by rising GDP, not by a decline in trade. It would be difficult to argue that this signifies a de-globalization as far as trade is concerned.

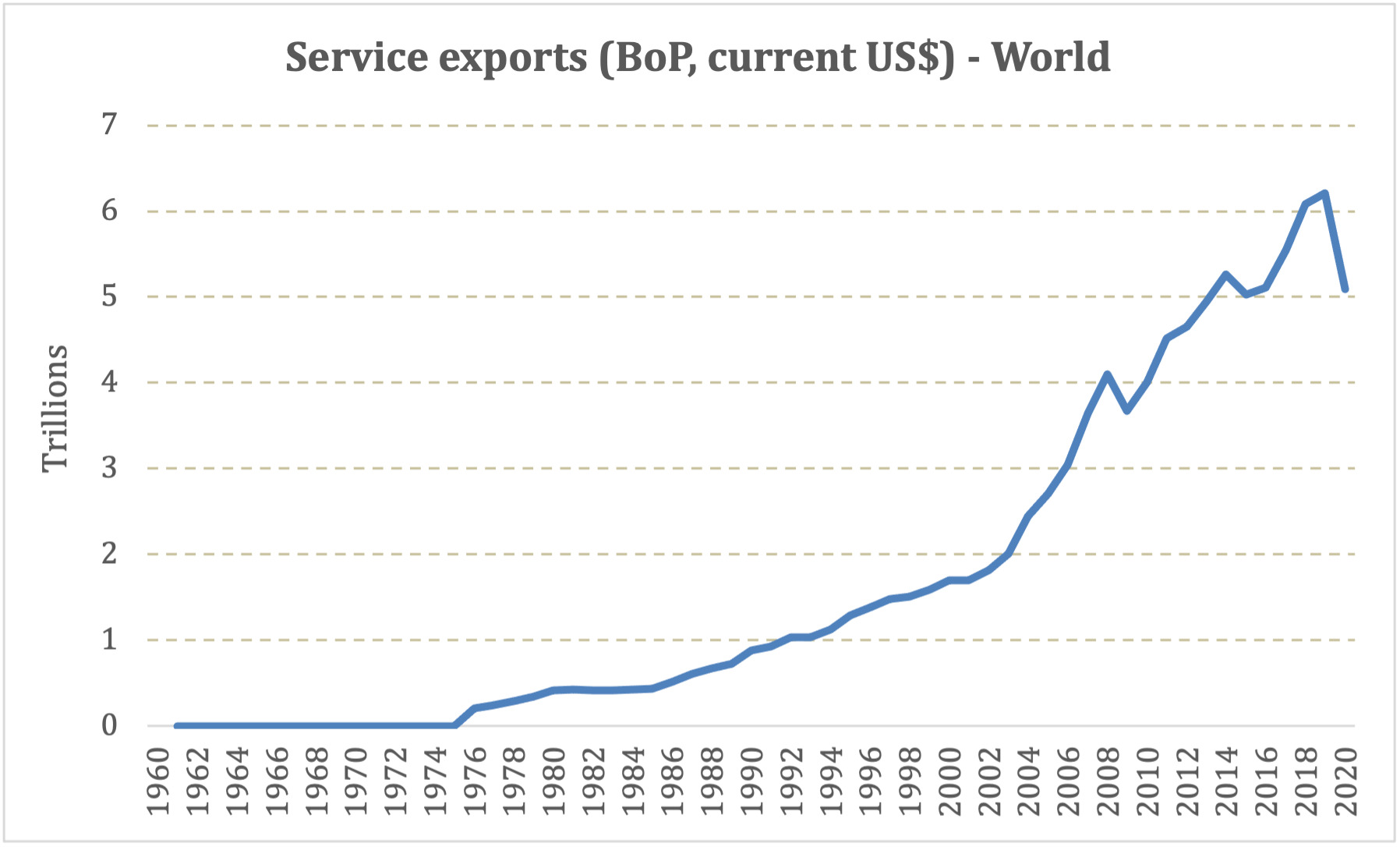

International trade in services has grown much more rapidly than trade in goods or GDP in the past half-century. As shown in Figure 2 the growth of services trade has not slowed during the past decade, with the exception of the 2015–16 anomaly and the COVID-19 pandemic in 2020, which produced declines in all trade and world GDP. This offers further evidence against the de-globalization narrative.

While international trade flows remained at historically high levels through the 2010s, there was also a great deal of focus on tariffs in the news media during the Trump presidency. That said, tariff barriers have fallen to very low levels around the world during the past several decades, as is shown in Figure 3.

For the Organization for Economic Cooperation and Development (OECD) countries – with the brief exception of the UK – average tariffs have been below 5% ad valorem since the mid-1990s. Average tariff rates for Brazil, Russia, India and China (BRIC) are notably higher, averaging well over 20% in the mid-1990s, though China had moved close to 7% by 2020, with Brazil and India closer to 15%. Notably, China began its broad tariff reduction process in the 1990s, as part of the requirements for joining the World Trade Organization (WTO).

While tariffs have remained quite low, there are quite a few specific exceptions, such as US tariffs and other barriers to auto and steel imports. Yet such restrictions are not new, having been imposed and later dropped by US governments from the time of Lyndon Johnson in the 1960s, through Ronald Reagan’s “voluntary” export restraints on Japanese car exports to the US, to Donald Trump’s auto and steel import restrictions, including most administrations in between. In the past, the implementation of such tariffs has not ushered in widespread protectionism, and claims that they will do so now should be viewed with skepticism. China also restricts imports of some products, such as autos, with tariffs and subsidies of domestic producers. Likewise, China restricts or otherwise keeps out foreign companies in telecommunications, banking, and other sectors viewed as important to national security. Both China and the US restrict some agricultural product imports, such as sugar and cotton in the US and wheat and rice in China. However, tariff levels for both countries remain low overall: 1.6% in the US and 3.4% in China in 2019, according to the United States Trade Representative and the World Bank.

Non-tariff barriers (NTBs) to international trade, such as import quotas and subsidization of domestic firms to fend off imports, are also potential source of de-globalization. As tariffs fell over the last several decades, NTBs have become the primary ways that states protect their markets, and the number of NTBs has increased in recent years, according to the 2021 Global Trade Alert. While rising NTBs are a concern, their impacts can also be mitigated by free trade agreements (Kinzius, Sandkamp, & Yalcin, 2019), which have proliferated concurrently with NTBs. Thus, the rise of NTBs need not pose a major threat to the survival of globalization.

The proliferation of free trade agreements (FTAs) has raised concerns that global trade will increasingly occur within regional blocs – fostering regionalism, as opposed to globalization. However, FTAs can shore up the multilateral trading system. Notably, FTAs have been a testing ground for rules later taken up in the WTO, such as WTO-level agreements on services and intellectual property. Additionally, states appear to seek FTAs to strengthen their position within the WTO (Mansfield & Reinhardt, 2003), suggesting that these agreements reinforce the WTO’s role, as opposed to detracting from it.

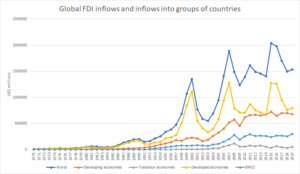

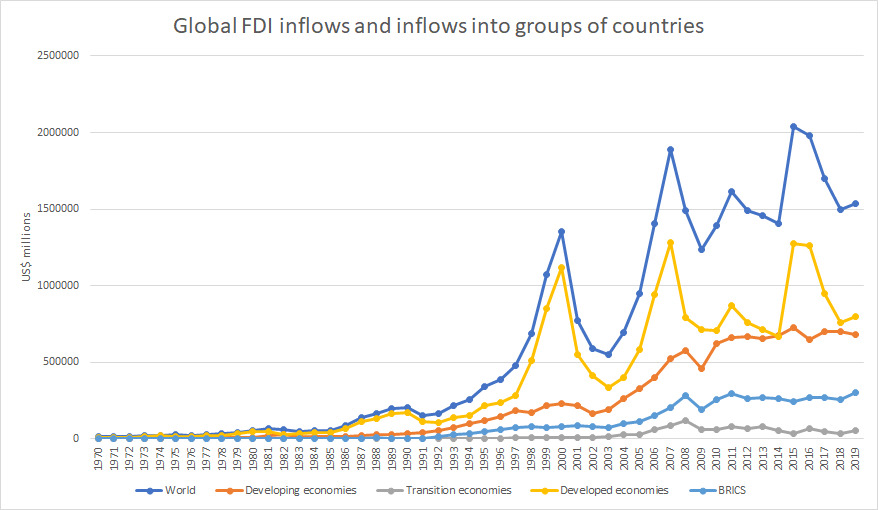

Additional measures of economic globalization include cross-border financial flows of various kinds. In particular, foreign direct investment (FDI) is a major source for the transfer of financial, managerial, and technical resources across borders. It is also an indicator of a country’s willingness to allow foreign business to operate locally. As shown in Figure 4, FDI has grown dramatically since the early-1990s, following the fall of the Soviet Union. After the Global Financial Crisis of 2008-9, FDI flows have been more erratic, yet they have clearly trended upwards.

Other international financial flows, such as portfolio investment into bonds and stock shares, as well as foreign exchange transactions, have continued to grow during the 2000s, aside from striking declines during the Global Financial Crisis. Foreign exchange transactions, predominantly in London and New York, grew from $US1.2 trillion per day, according to the triennial Bank for International Settlements (BIS) survey of April 2001, to $US6.6 billion per day, according to the same survey in April 2019. Portfolio investments have been very volatile during the 2000s, with an upward trend in both debt and equity flows. Aggregate portfolio flows grew at an annual rate of 44% from 2000–2019, with wide swings through the entire period. All three of the categories of financial flows – FDI, foreign exchange transactions, and portfolio flows – grew since 2000, demonstrating no evidence for de-globalization.

Data presented in this section show clearly that globalization has not declined during the 2000s or in the 2010-2019 period. The pace of growth of the trade and international flows has slowed, but these flows remained at or near their peaks in 2019. While not a focus of our analysis, it should be noted that international migration, too, has reached new highs in the late 2010s (De Haas et al., 2019).

Of course, 2020 introduced new challenges to globalization, as the impact of the COVID-19 pandemic on international business has been severe. Even so, COVID-19 and its effects have highlighted the dependence of companies on global supply chains and their vulnerability to breakdowns that might occur, such as the shutdowns of ports and other transportation methods. This subject was taken up in Insights recently (Vol. 20, Issue 3, 2020), with useful recommendations for companies, such as to pursue greater geographic diversification and to develop partnerships outside of densely populated areas.

Implications for International Business

While the macro-level data presented above clarify the degree to which globalization has persisted over time, individual companies are the traders and investors making the transactions that the data capture. These companies must reflect on their global business strategies in light of globalization-related policies that governments around the world undertake. A cursory look at the data above suggests that global businesses need not worry about de-globalization, nor should they anticipate significant hikes in tariffs or investment barriers. Indeed, perhaps the greatest risk for international managers would be to fall prey to the de-globalization rhetoric, and miss out on opportunities afforded by what we believe to be the far more likely development: continued robust overall trade and investment flows around the world.

While a dramatic reorientation is unlikely to be necessary for global companies, they should still develop flexibility. In particular, companies will have to account for the likelihood that the US and China will have frequent trade-related disputes, such as the 2019 trade war. Likewise, global companies must be prepared to adjust as the US and China continue to selectively decouple, as companies in each country may find themselves excluded from certain sectors in the other. This does not mean that the US and China will disengage with one another entirely or that either will withdraw from the global economy, as both countries have a vested interest the continuance of globalization and in maintaining the open economic system that supports globalization (Grosse, Gamso, & Nelson, 2021). US and Chinese companies can continue to engage with one another, but they should also diversify their partnerships, even if doing so creates higher day-to-day operating costs. MNEs based outside of China should look to other countries, perhaps in South and Southeast Asia, to diversify their offshore assembly of products such as electronics or clothing. These MNEs should also look to additional consumer markets for their products and services. Large emerging markets and fast-growing medium-sized emerging markets will be especially important going forward.

Of course, not all of globalization’s challenges relate to US–China relations. Pressures on international companies to carry out more activities locally, pay more local taxes, employ more local people, and bring in new technology exist in most countries, and companies need to respond to these pressures. In addition, some sectors, such as hydrocarbons, are likely to face increasing scrutiny and restriction, such that companies in these sectors should consider diversifying into downstream or upstream activity or even moving into different industry sectors. The overall implication for international firms is that they need greater focus on risk management: to diversify their activities and reduce the negative impact of potential restrictive government policies; to adapt their businesses, for example, by contracting out activities as Apple does; to transfer risk where possible to insurers such as the World Bank’s Multilateral Investment Guarantee Agency, AIG, or other third parties; and to avoid high-risk activities and locations where possible.

While the COVID-19 pandemic is likely to abate as vaccination rates rise and other treatments emerge, it has wreaked havoc on domestic and international business around the world. Companies have seen the risks involved in operating very lean supply chains that are vulnerable to disruption and they should recognize the importance of managing disruption risks through strategies such as geographic diversification of the business and of suppliers. Government policies to restrict business activity and travel during the pandemic are temporary, but they do illustrate the kinds of government interventions that international companies should plan for, whether related to protectionism, health conditions, or other factors. Additionally, some pandemic-related adjustments may be permanent, such as the use of videoconferencing to replace some, but not all, business travel.

COVID-19 aside, government policymakers need to recognize explicitly that erecting barriers to trade and investment (other than to prevent foreign governments or companies from breaking internationally agreed upon trade rules) will impose higher prices on domestic consumers and lower the availability of products. This cost may be politically justified for a government interested in satisfying a domestic pressure group, but it is a cost to the country overall. Thus far, elected governments that campaigned on nationalist platforms have not implemented strongly protectionist policies, but the past is not a guaranteed predictor of the future. The challenge for policymakers hoping to keep anti-globalization movements at bay will be keeping their economies open to trade and investment while simultaneously shielding workers in vulnerable industries from the devastating impacts that can accompany job loss. To the extent that governments can accomplish both tasks successfully, populist and economic nationalist opposition to globalization can be overcome.

About the Authors

Robert Grosse (robert.grosse@thunderbird.asu.edu) is Professor of International Business and Director for Latin America at Arizona State University’s Thunderbird School of Global Management in Phoenix, Arizona. He was President of the Business Association of Latin American Studies in 2005-6 and President of the Academy of International Business during 2012-14. He has written on strategies of multinational firms, business in Latin America, and on management in emerging markets.

Jonas Gamso (jonas.gamso@thunderbird.asu.edu) is an assistant professor at Arizona State University’s Thunderbird School of Global Management, as well as a senior sustainability scholar in the Julie Ann Wrigley Global Institute of Sustainability. His research focuses on global political economy and international development and has been published in the European Journal of International Relations, International Studies Quarterly, the Journal of World Business, and other journals.

Roy C. Nelson (roy.nelson@thunderbird.asu.edu) is Associate Professor and Senior Associate Dean of Undergraduate Programs at Arizona State University’s Thunderbird School of Global Management. His research focuses on business-government relations in developing countries and has been published in a wide range of journals, including Studies in Comparative International Development, the Journal of World Business, and Latin American Politics and Society.

Populism does not necessarily correspond to anti-globalization, but the modern wave appears to be connected to anti-globalization sentiment (Rodrik, 2018).

For example, polling from Pew’s Global Attitudes survey in 2014 – a point during which US support for populism was brewing on the left and the right – showed that fewer than 20% of Americans believed that trade creates jobs or raises wages (Stokes, 2014).